This article was printed in

Chic Compass Magazine – Issue 6

Navigating a Financial Hurricane

BY STACEY GUALANDI

Six months have passed since the global pandemic first triggered a tidal wave of economic panic across the country. The ripple effect is affecting people’s livelihoods, their life savings, and their homes, and making it almost impossible for many to keep their heads above water.

“We’re having a financial Armageddon right now, if you will, that is tied to a medical event—finance and medicine—and it’s like the perfect storm,” financial consultant Joe Pantozzi says.

Pantozzi is the CEO and founder of Alpha Omega Wealth. The Las Vegas-based financial consulting firm helps clients build prosperity and wealth without Wall Street. Now more than ever, people are admitting they need help with their money—or lack of it—but he admits, navigating these rough waters without fear requires a strong financial compass.

“People are going to have to find a new way to live, to make money, and to find new work,” Pantozzi says. “They’ll have to start from scratch because you’ve only got two options: you can go hang out at the rescue mission downtown and stay there for the rest of your life, or you can do something new.”

With 44 years of consulting clients under his money belt, Pantozzi says his goal is to teach people the skills needed to steer in the direction of a secure future.

“My whole career has been about encouraging and coaching people on preparing for the future, so this is really tough medicine. There’s nothing I can do to help somebody who has nothing in the bank,” Pantozzi admits. “But if someone says to me, ‘I’m going to do whatever I have to do…so now teach me what I need to do,’ then I’m going to say, ‘Okay, we need to protect your income going forward.’”

Rule #1: Pantozzi says, start with a strong foundation, which means saving three to six months’ worth of living expenses in the bank.

“You need to save money in an emergency fund,” Pantozzi insists. “But for that person who is living paycheck to paycheck, they’re going to have to go back and swallow that bitter pill and say, ‘Okay, I’m going to start saving. I’ll start small…saving 5% of everything I make. Then, six months from now, I’ll graduate to 10 percent, 15 percent, then 20 percent; I’ll start to live beneath my means,’ because no matter what happens in the future, you’re going to need an emergency fund should something like this [pandemic] happen again.”

Pantozzi knows this from experience. He says he and his wife were in terrible financial straits when they first met 32 years ago.

“I had just gone through a divorce with kids, and I was paying child support and paying all the debt. I had no extra money. I didn’t even have my rent.”

So they committed to paying off debt, increasing their means, and putting as much money as they could into safe savings.

“I went through prostate cancer many years later, and, during that time, I wasn’t very effective with my clients and was unmotivated. I had interruptions with that medical issue every single day, so I had to rely on my savings to a great extent, and because the system that we had set up [years before] was so effective, we didn’t miss a bill.”

Rule #2: Pantozzi says financial literacy is essential in investing wisely for retirement.

“One of my foundational principles is to teach my clients to embark upon a course of education in finance that is going to last them the rest of their lives. Then they transfer [that knowledge] down to their kids, grandkids, great-grandkids, and so on, so that they can create cross-generational wealth.”

And Rule #3: According to Pantozzi, one hundred percent of monetary stability and progress is about the way you think long term.

“On the one hand, you could say money is a force and money does certain things and money is going to cause certain tides and currents and waves. I don’t agree with any of that. I encourage [my clients] to think about the fact that they are in control. We can decide to be at the mercy [of outside sources], or we can decide not to be and take control.”

In other words, Pantozzi says to stay afloat financially, you need to stop making waves and go against the tide when it comes to your money management.

“For people who have had the rug pulled out from under them, they need to move away from what the majority is doing and make a new game plan. You have to do things radically because you’re never going to get out from under the debt you have unless you create an aggressive plan. Don’t wait for somebody else to come and bail you out, because it’s not going to happen.”

While the 2020 financial crisis has left us all in uncharted territory, Pantozzi says now is the time to get back on course so you can stop treading water for good.

“The only way you can get out of it is by choosing to get out of it and doing something radical, aggressive, and that engages your passion.”

Learn more at:

AlphaOmegaWealth.com

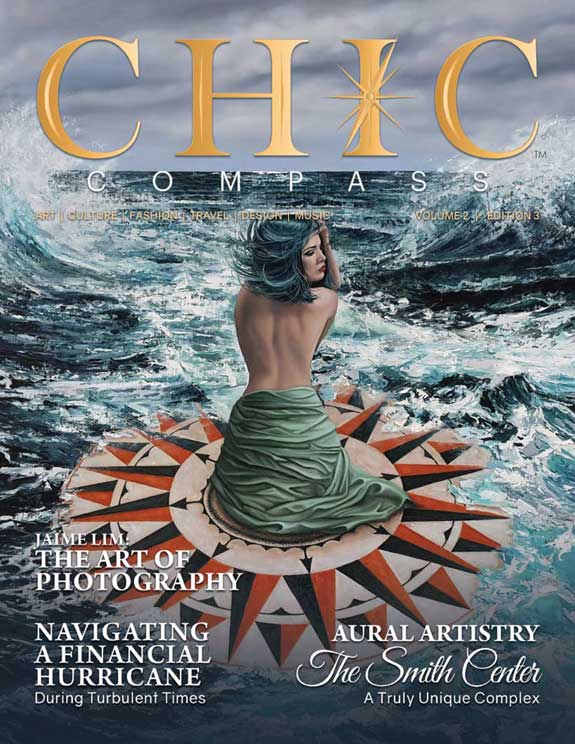

Katarzyna Kociomyk beside her painting, “Weathering the Storm” 48” x 60” Oil on Canvas